Defi finally has its first pawn protocol, with wassiepawn launching it’s NFT pawnshop. That’s pawn, not the other sort, the internet has enough of that already. That this is defi’s first protocol of this kind may be something of a hot take. Allow us to explain.

Surely Defi has lots of protocols like this?

I can already hear the outraged screams. What about AAVE, what about Alchemix!? These are all amazing protocols led by amazing teams, and have done a huge amount to expand the scope of defi. But these are a different sort of protocol. They are leverage protocols. In each case a user wanting to receive an advance from the protocol must overcollateralise a loan, depositing fungible assets of a higher worth than the amount they wish to receive. These fungible assets can then be liquidated if the market moves in the wrong direction, ensuring that the original loan value is always recouped by the protocol.

This is great if you want to get leverage. You can deposit a token you maintain a long position on, receive a percentage of that token’s worth, and use that token however you want. And while this is leverage it isn’t a pawn style arrangement. If you were to note down the actual transactions in a cash flow more has flowed to the protocol than from it. If anything you have given a loan to the protocol. Let’s use an example to illustrate this. Your friend asks for a $200 loan, which you say is fine, as long as he gives you $220 to custody during the loan term. I suspect your friend might not be interested in these terms. Even less so if you point out that should the value of the $220 drop against some peg you just get to keep the $220. . .

So what is a pawn transaction?

While pawning something is a financial transaction, there is also a social contract at work.

There is an exchange of risk and reward. If we take lending protocols like AAVE, the loan is over collateralised with a fungible asset which can be instantly liquidated. Therefor the lender is taking zero risk on that loan. There are wider market risks for the lender, but in terms of that one loan they cannot possibly lose.

Let’s take a home loan as a different example. These are also often over collateralised, the bank advancing say 80% of what the house is worth. But the asset backing the loan is very illiquid, and it’s value can’t be instantly realised by the lender. Plus, if the value of your house goes down the bank doesn’t get to insta-sell it on your behalf when it reaches a certain value based on your loan’s health factor. That would be awful! The bank can’t touch your house if you keep within your terms. They therefore are sharing in asset risk with you. And this is critical. For a true pawn transaction with an implied social contract you need the following:

- Risk – both service provider and user have an interest in the asset, and are taking a risk on its future value. But the user is taking more risk, as in the case of default the service provider repossesses the asset.

- Reward – upside risk on the asset belongs to the user. The reward for the service provider is interest and fees, that should be calculated to accurately defray this risk.

So where does wassiepawn come in?

NFTs are illiquid assets. They share a number of characteristics of personal, physical property that fungible tokens do not.

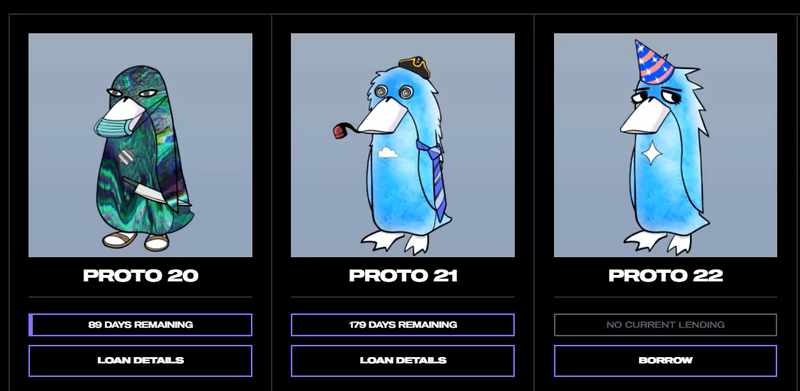

At wassiepawn you can now pawn your loomlocknft (also known as wassies). The protocol will custody your NFT for the term and transfer you an agreed sum of ETH. It will also charge a fee that is added to what you have to pay to reclaim the NFT. Repay and get back your NFT, or extend the term by paying an extension fee.

That’s right. This is the world’s first NFT pawn protocol.

This protocol is different than any that already exists for the following reasons:

- We are pawning an illiquid asset. Most assets in the world, and increasing numbers in crypto, are non-fungible and illiquid. This is the first protocol for this asset class. If the metaverse is to grow and really challenge tradfi there will have to be lots more of this sort of thing.

- Wassiepawn is taking genuine asset risk with you. If wassies go down in value they can’t touch your asset custodied in the contract as long as you remain within your terms, which is as simple as making sure you don’t go beyond the end date.

- As the service provider is taking genuine asset risk it becomes increasingly important for them to understand and apply analytics to that risk. The residual value of the asset at the end of the term is now really important.

Revolution?

NFTs are a bridge between Defi 1.0 and the ability for Defi to genuinely take on the banks and the finance houses. When we get NFT pawning humming Defi can turn its attention to houses, and cars, and medical equipment and solar farms and. . .

And it all begins with pawning your loomlocknft. Take a note of the date. You read it here first. Are you in?

From loomdart

All of the lovely text above was written by the wonderful Loremaster Omnus. A random member in our community who approached us after we first announced Wassie Pawning on wassiepawn. Omnus has been instrumental in the development and deployment of this product, from concept to code. This is the true power of a community of people who are aligned with you to help build dope shit together. Wassiepawn is the first product we will be providing that brings actually useful features to the NFT holders. Liquidity is an active problem with the NFT space, and we view this as a solution to this issue. While the launch of this product is very grand, it is in by no means the end state. We view this as an early alpha, and will be using the immense data and usage statistics from this product to help expand and evolve upon the concept, integrating more and more features overtime.

We love Wassies, and we love Pawn! WassiePawn! WassiePawn for everyone!